A new paper published ONLINE FIRST with free READLINK provides robust evidence for the Netherlands that policies targeted at working mothers with young children generate the largest labor supply responses but generate little additional government revenue. Introducing a flat tax, basic income or joint taxation is not effective.

The Global Labor Organization (GLO) is an independent, non-partisan and non-governmental organization that functions as an international network and virtual platform to stimulate global research, debate and collaboration.

Analysing tax-benefit reforms in the Netherlands using structural models and natural experiments

by Henk-Wim de Boer and Egbert L. W. Jongen

Published ONLINE FIRST 2021: Journal of Population Economics

FREE ACCESS: Readlink: https://rdcu.be/cloOs

Author Abstract: We combine the strengths of structural models and natural experiments in an analysis of tax-benefit reforms in the Netherlands. We first estimate structural discrete-choice models for labour supply. Next, we simulate key past reforms and compare the predictions of the structural model with the outcomes of quasi-experimental studies. The structural model predicts the treatment effects well. The structural model then allows us to conduct counterfactual policy analysis. Policies targeted at working mothers with young children generate the largest labour supply responses but generate little additional government revenue. Introducing a flat tax, basic income or joint taxation is not effective.

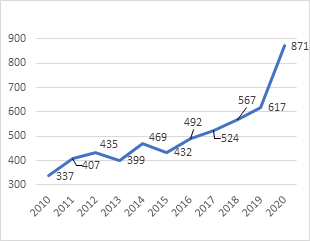

EiC Report 2020

Journal of Population Economics

Access to the recently published Volume 34, Issue 3, July 2021.

LEAD ARTICLE OF ISSUE 3, 2021:

The safest time to fly: pandemic response in the era of Fox News

by Maxim Ananyev, Michael Poyker and Yuan Tian

OPEN ACCESS: Free Readlink – Download PDF

Ends;